When to Buy Real Estate... Yesterday... Today... & Tomorrow!

Can you lose on real estate in Tampa Bay over the long haul?

When asked this question, I have a very confident answer. For short-term investing strategies, real estate investors can get burned like any other industry. It happens every decade or so in any and every market. So yes, any short-term investing is volatile and risky. But in the long-term, I am extremely bullish on the Tampa Bay market. I believe property values over the next 10 years will reap incredible returns.

Very few industries, services, or commodities can claim the same fortitude as real estate investing. Especially in a unique market like Tampa Bay. President Franklin D. Roosevelt once said, “Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.”

For starters, many in the area are expecting the housing bubble to burst in Tampa Bay. There will be corrections. There will always be ups and downs. Just look at the ocean. Those are the waves of life. Up and down. Up and down. Sometimes higher—sometimes lower. But in the long run, history has proven the real estate market always bounces back.

Take the 2009 housing crash for example, home values were artificially driven by risky investments and under-regulated lending. Overnight values dropped 30% so a home valued at $320,000 dropped to $225,000. That same home, worth $225,000 in 2009 is now worth double—$450,000—12 years later.

So, what’s the value of these statements I am making? Buy when you can—however you can—regardless of where the market is at.

Tampa Bay, specifically Pinellas County, is now a comparable to San Diego, San Jose and even Denver. San Diego is probably the best comparison—military town, retirement town, nice climate, limited land—nothing but fun in the sun.

One thing Tampa Bay doesn’t have versus these other three markets is high paying jobs. We just do not have enough of those positions yet. However, Tampa Bay closes that gap, with more high-paid professionals able to work remotely, no state taxes, homestead laws and short-term rental opportunities driving investors.

This also means drastic home price drops will become less likely, and plateaus more the norm. Keep in mind as soon as prices drop or equalize, investors from around the country will be picking up properties as the desire for our dirt for a get-a-way is premium. That is a disadvantage to us as locals. We want to keep the wealth of our land in the hands of the people who make up our community.

I share this as an encouragement to the locals who desire to purchase a home in this very difficult low supply housing market to keep the goal of home ownership. Despite how difficult it may seem—or expensive—the financial benefits in the future will be worth it.

I’m also referencing something else to my local neighbors. This sacrifice you make today will be very beneficial to your children and heirs. This is the foundation of generational wealth—the biggest advantage one can have in a capitalistic economy. Look at other markets that had major growth a half century ago. Some of the wealthiest families in California made their money in real estate. In Tampa Bay, real estate will be the name of the game—not cash, gold, or cryptocurrency. In Tampa Bay he or she with the most real estate owned will be in the strongest economic position and most importantly so will their heirs.

Get in the game. Stay in the game. Do not get deterred. There are many excellent real estate and mortgage professionals here locally that can make these dreams become a reality. Call me for more info.

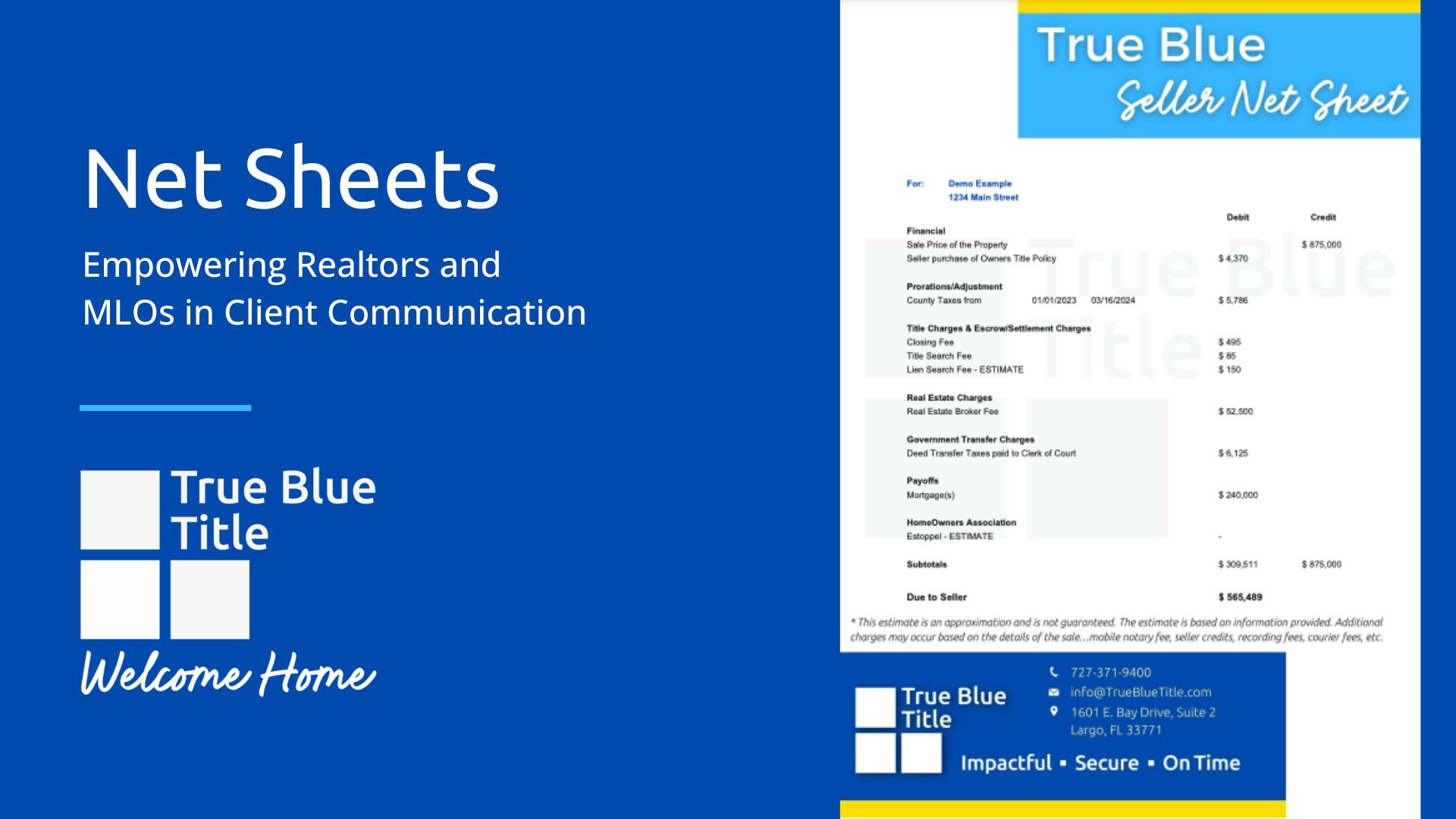

George Klimis is the co-owner of True Blue Title. He can be reached at George@TrueBlueTitle.com or 727-243-1724.

Subscribe to True Blue Confidential for information and inspiration for Tampa Bay's Real Estate Marketplace