Generation Z and New Homebuyers: Demystifying the Home Buying Process

Buying a home seems complicated, but is it really?

Although buying a home may seem complicated, I’m here to tell you it’s not as daunting as it seems. As a 19-year-old a part of Generation Z, buying a home seems daunting and complicated. However, after doing my research and learning more, I’m here to tell you it is not.

The First Step: Finding the Right Real Estate Agent and Lender

When you decide it’s the right time for you to buy a home, the first step is finding yourself a real estate agent and a lender. Asking for recommendations from family and friends and doing research online is a great place to start. By building a relationship with a real estate agent prior to buying a home, you’ll have someone you can trust when you’re ready to begin the process. Your lender would be the bank that you’re receiving loans from, which is even easier to find.

The Role of a Realtor, Lender, and Title Company in Buying a Home

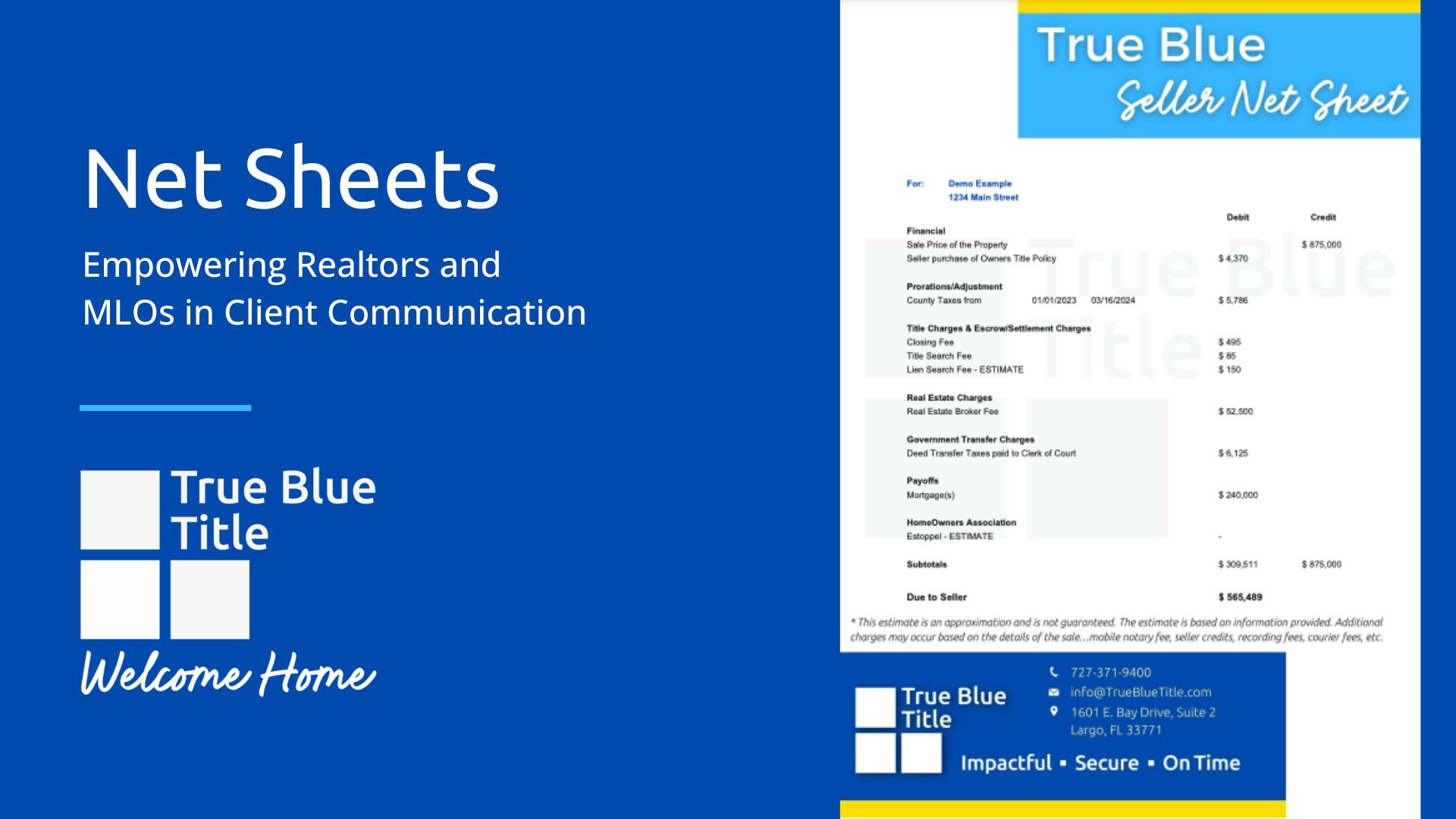

George Klimis, co-owner of True Blue Title, says that if you have a realtor, a good lender, and a good title company, they really hold your hand through the process; they tell you what to do step by step.

Here are some key questions you want to ask your realtor:

- Is the home in a flood zone?

- How old is the roof and major appliances?

- What are the current taxes and what are the projected new taxes after I purchase? (Pinellas County Property Appraiser Tax Estimator will get you estimated.)

- What school zone are you in and the rankings? (Even without kids, try to be in the best school zones for resale value.)

- Is the seller willing to make any “seller concessions?” (This is when a seller gives you incentives to buy the house, such as money to paint or do repairs or pay for your interest rate to be lowered.)

- How many years of experience does the realtor have? Or, ask them to share the most recent transactions they had with buyers.

- Research, research, research. Not all realtors are built equally.

- Find a trusted mentor that’s purchased a home. Maybe family or friends or professional colleagues.

After you’ve picked your realtor and lender, it’s time to find a house. After you tell your realtor what you’re looking for, they will do most of the work for you. All you will have to do is tour homes until you find your perfect match.

Crucial Questions for New Homebuyers to Ask Their Lender/Mortgage Loan Officer

To ensure you're making an informed decision, it's essential to ask the right questions—crucial questions that every new homebuyer should ask their lender or mortgage loan officer. This will help you understand the mortgage process, provide clarity on your financial commitments, and aid you in securing a loan that aligns with your needs and financial capabilities.

Questions to review with your lender/mortgage loan officer:

- What are your upfront fees?

- What loan programs do you offer for first-time home buyers or programs for specific professionals?

- Do they have any “buy down” options? (This is paying money to lower the interest rate over the first few years.)

- Do you have interest-only loan options?

- Do you work with Down Payment Assistant programs?

- Search lenders on https://www.nmlsconsumeraccess.org/ for important information.

- Interview and get quotes from at least two lenders to ensure your rate is the best.

- Discuss rate lock strategy.

- Read reviews!

The Next Steps: Property Inspection and Title Review

Next, the house must pass a property inspection and receive repairs if needed. Most if not all lenders will not allow a purchase of a home that does not meet structural standards. The same with insurance. Homeowners insurance in Florida is also strict. So roofs, for example, must have 20 years of life left, or they will need to be replaced.

Both parties then review the title commitment, also known as the preliminary report. In this, the title company you chose discloses defects, liens, and obligations that affect the subject property to all parties involved in the real estate transaction. Title insurance offers coverage against defects in title caused by fraud, forgery, incapacity, impersonation, or the seller’s lack of authority to sell the property.

The Final Stages: From Paperwork to Possessing Your New Home

Once the clock starts, you are expected to promptly respond to requests for information or paperwork. This will make for a smooth “closing” on your new property.

Also, once you put your new home into contract, you are then ready to deposit the closing funds via wire transfer. Invoices and information are then delivered to the lender/escrow officer at least 10 days prior to signing.

It’s now time to sign the loan documents and the closing paperwork. You will then receive the keys to your new home.

Resources and Help are Available for Generation Z Homebuyers

These are the big milestones you will go through purchasing your own home but do not despair. Real estate is one of our nation's biggest industries, and there are plenty of resources and vendors to walk you through the final stages. For example, there is a company called Utility Helpers. Its sole purpose is to automate transferring of utilities, et al when moving.

Buying a home may seem like a daunting task, but there are people to help you along every step of the way.

Need more information about title insurance and buying a house? Checkout our

Borrower Resources page.