Common Title Search Issues: What Will Derail Your Real Estate Deal?

Why do we need a title search & insurance?

It's a common, yet misguided, question that many homebuyers and sellers often ask: "Why do we need a

title search and title insurance?" For many, it feels like an unnecessary step, a formality that unnecessarily delays the thrill of closing the deal. However, the reality couldn't be more different. As complex as real estate transactions can be, the title search is your safety net, your assurance that the property you're about to invest your hard-earned money into has a clean slate, free from legal and financial entanglements.

Common Title Search Issues

Ownership Disputes

Ownership disputes are among the most common issues that crop up during a title search. In these situations, multiple parties assert that they hold ownership rights over the same property. Such a conflict can lead to legal entanglements, financial loss, and even the collapse of the deal if not addressed appropriately.

A Potential Scenario

Imagine this scenario: You've just closed on what you believe is your dream home. It's a charming property, seemingly perfect in every way. But one day, there's a knock on the door. It's the previous owner's ex-spouse. In their hand, they hold a legal document that was never disclosed during the sale process — a claim stating they still hold rights to the property as part of an unresolved divorce settlement. Suddenly, your dream home becomes a battleground, and you're caught in the middle of a dispute you had no idea existed.

The True Blue Solution

At True Blue Title, we believe that prevention is the best solution. A thorough title search conducted by our experienced team can identify potential ownership disputes early in the process. We then ensure they are addressed and resolved before you make your final purchase, thus protecting your investment and your peace of mind.

Forgeries

A more insidious issue that can arise during a title search is forgery. This occurs when an unscrupulous individual fakes a previous owner's signature or other critical documents to illegally transfer property.

A Potential Scenario

Imagine this unnerving situation: You've just moved into a cozy, vintage home that once belonged to a kindly old woman. You bought it from her only son, who seemed eager but legitimate. A few weeks into settling in, you're suddenly confronted by a group of people claiming to be the other children of the previous owner. They produce legal documents indicating they are rightful heirs to the property, accusing their brother of forging their mother's signature to sell the house without their knowledge or consent. Suddenly, your new home sweet home has turned into a legal minefield, with you and your investment caught in the crossfire of a family feud.

The True Blue Solution

Forgery is a serious crime that can lead to substantial legal issues for an unsuspecting buyer. To mitigate this risk, our team at True Blue Title meticulously examines every document and verifies the authenticity of each signature. Our keen eye for detail and commitment to due diligence helps to safeguard your real estate transaction from such fraudulent activities.

Back Taxes

Another potential hiccup in a real estate deal is the existence of back taxes. These are property taxes that a previous owner failed to pay, which can become a burden for the new owner if not identified and settled before the transaction.

A Potential Scenario

Imagine closing on your new home, celebrating the milestone, and then receiving a hefty bill for unpaid property taxes. The previous owner's financial negligence has suddenly become your unexpected liability, casting a shadow over your new home's joy.

The True Blue Solution

At True Blue Title, we ensure that no unpaid taxes are lurking unseen to disrupt your deal. We conduct a comprehensive title search that includes checking for any outstanding property taxes. By discovering and resolving these financial obligations before closing, we keep your real estate transaction on track and protect your financial interests.

Filing Errors & Liens

Sometimes, the smallest details can lead to the biggest headaches. Filing errors, such as incorrect information or misspelled names on a deed, can cause complications. Liens, claims made by creditors against a property to secure unpaid debts, can also put your investment at risk.

A Potential Scenario

Perhaps you're closing on a property, only to discover a lien for an unpaid contractor's work or a missed mortgage payment by the previous owner. These unforeseen debts now threaten your claim to the property and could result in financial loss.

The True Blue Solution

To avoid such situations, the True Blue Title team meticulously reviews all filed documents and checks for any outstanding liens. Our thoroughness helps to ensure that filing errors are corrected, and liens are settled before you take ownership. In doing so, we protect your transaction and investment from these often overlooked but critical details.

The True Blue Difference: Excellence in Title Search Services

While the cost of a title search is standard across all companies, the quality of service is not. At True Blue Title, we pride ourselves on our competency. We go above and beyond to ensure all documentation is accurate, thorough, and ready for your closing day. Our team's expertise helps you avoid unwelcome surprises, making the process easy and stress-free.

Service-First Mentality: Personalized Support for Your Real Estate Needs

In an age where real estate transactions can feel increasingly impersonal, True Blue Title stands out with our service-first mentality. We are here to serve the unique needs of real estate professionals, buyers, and sellers, offering a high level of personal support. We understand that every client is unique, and we are dedicated to providing you with personalized solutions.

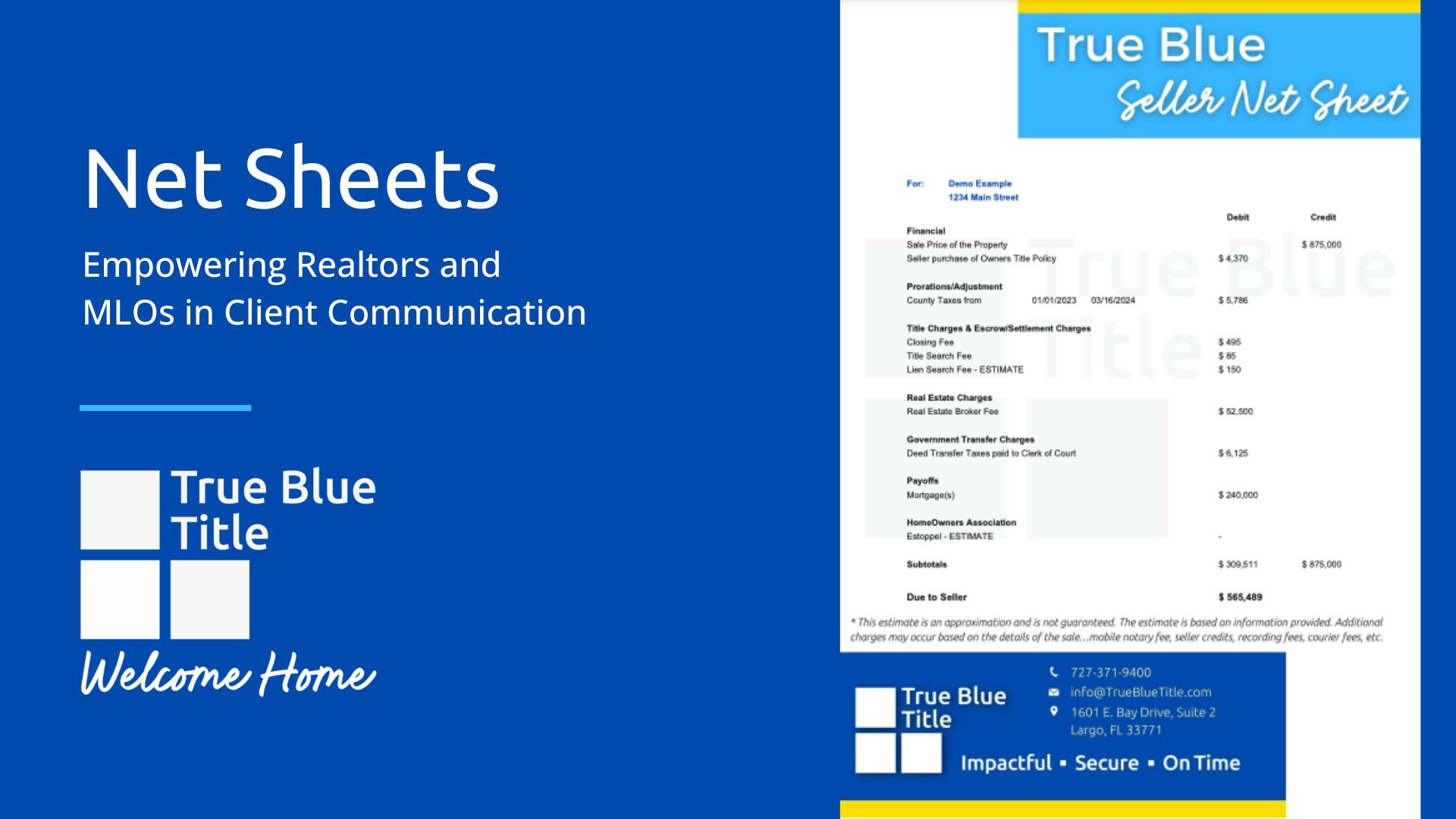

Take Action with True Blue's Net Sheet Calculator

Why wait until the last moment to estimate your home's sale proceeds? Check out our Net Sheet Calculator and get a quick, reliable estimate now! Visit True Blue's Net Sheet Calculator and empower yourself with the right information. At True Blue Title, we strive to put you in control of your real estate transactions.

Call True Blue Title at 727-371-9400.